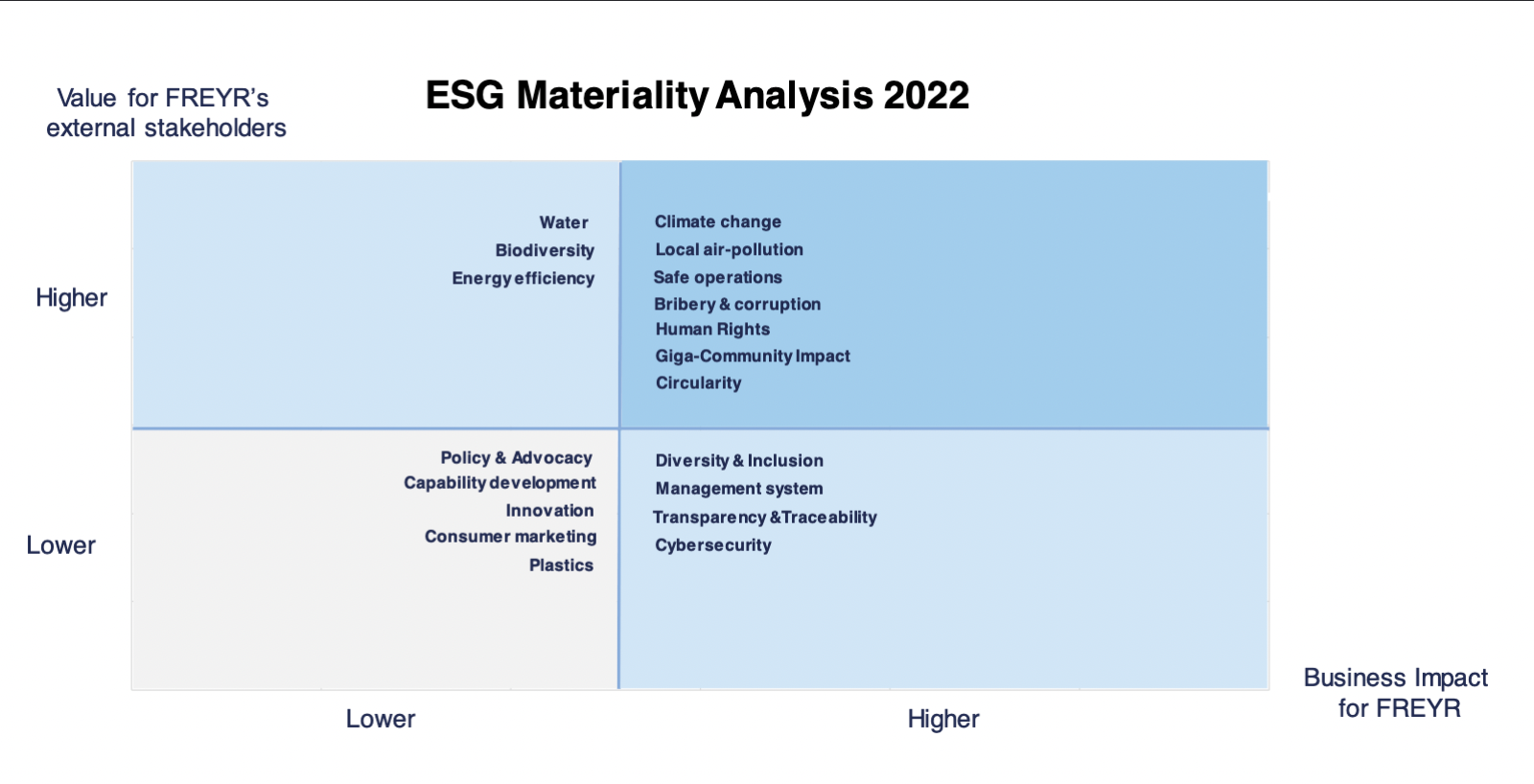

ESG Materiality Analysis

FREYR did its first materiality analysis in 2022 and it was updated the end of 2023. It was conducted through following the process as described in GRI 3.

Baseline establishment

In order to understand FREYR’s context in the space of ESG, in 2022 FREYR conducted an employee survey, interviewed all executives of the company

one-to-one, and held sixteen conversations with external stakeholders

and experts. FREYR also conducted a media analysis of ESG issues

pertinent to the sector and analyzed and identified ESG issues by

relevant industry associations such as the Global Battery Alliance.

From

the survey of all employees, all the input from external conversations,

the findings in the risk and opportunity overview as well as the input gathered

through in-depth interviews with all members of top management, a draft

ranking of the issues was made. This ranking along the two axes

as shown in the graph below, was then discussed again with top

management and experts, before the Board of Directors approved the view as shown below.

The

ranking in each of the four sectors in the materiality analysis is

arbitrary and not meant to indicate internal ranking of the issues. It

is early days for FREYR, and the level of precision is deliberately chosen accordingly.

In 2023, we had new conversations with the key stakeholders, where we reconfirmed the result of our first analysis

Continued process

As part of FREYR’s quarterly risk assessment process, all management teams are asked to consider the environmental, social, and human rights risks and opportunities for the business. With this input and further assessments, an ESG risk map for FREYR’s top ESG risks was established. The risks and mitigating actions are discussed with the Board of Directors’ Audit and Risk Committee on a quarterly basis