The Three C's of Battery Success: Capacity, Competence, and Competitiveness in the U.S. Market

May 10, 2024

The worldwide transition to clean energy continues to accelerate—and the battery industry has reached an inflection point. A recent report by the International Energy Agency emphasizes that momentum around batteries is growing, with battery deployment in the power sector posting an increase of more than 130% in 2023 alone. But the question of whether the U.S. market is poised to harness this momentum remains an open one — and the answer may depend on steps taken at this critical moment.

With higher demand, lower costs, and new technological advances, it’s clear that the stage has been set for the battery industry’s growth. The hard logic of the market dictates this: solar power combined with overnight battery storage now provides the cheapest source of new energy discovered so far. For this reason, the world is entered an era of unprecedented growth in electrification across all sectors of the economy. Of course, the growing share of renewable power comes with the massive benefit of helping to solve the climate crisis-but at this point, this energy transition is going to happen regardless of those benefits, thanks to advancing technologies, pricing, and policies.

Tom Jensen — co-founder and executive chairperson of FREYR, a producer of next-generation battery cell production capacity — puts it succinctly: “For nearly two centuries, we’ve relied on fossil fuels — building our infrastructure, our economy, and for many, our way of life around it. Today, however, that’s changing.”

To ensure this phase of growth leads to sustainability and longevity for the U.S. battery market, the industry will need to cultivate a strategic, long-term perspective. Looking ahead, FREYR has identified three critical elements to ensuring success: building capacity, developing a competent workforce, and pursuing competitive results through innovation.

To build capacity, the on-ramp for getting companies launched and battery factories up and running needs to be as frictionless and as expedited as possible to feed growing domestic demand. Governments should do their utmost to be forward-thinking and to implement policy designed to reduce the burden on investors.

The U.S. has emerged as a leader in this regard with the passage of the Inflation Reduction Act in 2022. This private sector-led, government-enabled approach has already proven its potential, helping to stimulate nearly $360 billion in clean energy investments from private companies. This is in part what drove FREYR to make a major investment in Coweta County, Georgia, where construction of a new Gigafactory is underway.

Cited by a recent article in Investment Monitor as a standout for manufacturing opportunity, Georgia is experiencing a manufacturing investment boom. In a recent interview with Inside Climate News, FREYR CEO Birger Steen explains what drew FREYR to the region: “The reason we prioritized Georgia over other stateside locations was many of the same factors [as our Norway location]: very central, great airport close by, railroads, access to the port facilities, either by road or by rail, great partnership with local community, great welcome, a strong base of resources, local skills everywhere from sort of trade school level all the way up to the postdoc level.”

Connections to local education networks will be key to the success of the Gigafactory, and this points to the second critical element in FREYR’s long-term vision: developing a competent workforce. In Norway, FREYR was central in Battkomp, a collaborative project facilitated by Norwegian Industry (part of The Confederation of Norwegian Enterprise) to build battery competence and training. As part of Battkomp, FREYR has worked closely with both industrial actors and educational institutions to develop the national framework for skills for a new industry and more specifically developing short modules and longer conversion courses for several schools.

Building on this success, FREYR has now also formed local partnerships with educational services such as Georgia’s Central Educational Center — a joint venture program between high schools, colleges, and businesses designed to train a workforce for success in local industry. The company is also partnering with the Technical College System of Georgia, whose rise in recent enrollments can be attributed to recent manufacturing investments in the region.

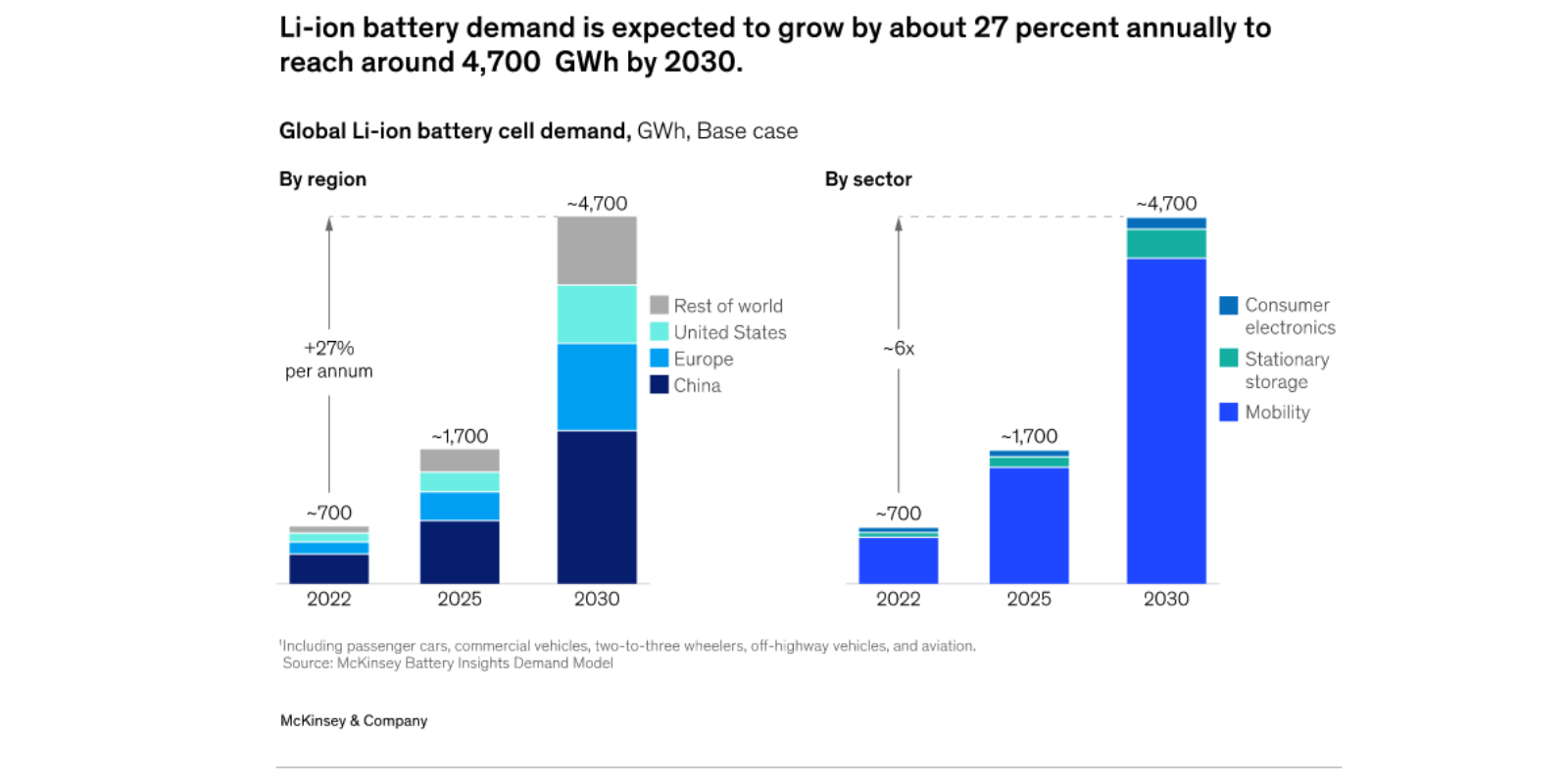

The economic opportunity in the battery industry is substantial, with high levels of growth projected in the coming years. A 2023 McKinsey report predicts that the entire lithium-ion battery chain alone could grow by over 30 percent annually from 2022 to 2030 and reach a value of more than $400 billion and a market size of 4.7 TWh.

But growth will have to be led with continual innovation and agility. The same McKinsey report highlights the uncertainties of the global battery supply chain, stemming from factors such as the risk of oversupply of some materials and undersupply of others.

It also stresses the challenges of the industry’s rapidly changing technology and the importance of focusing on innovation: “When making investment decisions, battery manufacturers could find these rapid advances challenging,” the report notes. “After choosing the battery technology that fits their application needs best, they should then quickly secure the required raw material upstream, acquire the capable machinery mid-stream to suit the battery chemistry and application, and recruit the indispensable talent required for those projects.”

Steen is sanguine about FREYR’s pursuit of this third critical element and sees potential for innovation and technological improvement in the opportunity presented by the IRA: “While we know that the larger energy transition won’t happen overnight, we can accelerate the transition through thoughtful policy,” he says. “The IRA is the largest single investment ever in the climate space. It has also allowed us to catch up on R&D and commercialization opportunities, and it has provided us with financial support for developing technology and for scaling production at competitive costs. We have been able to count on a level of predictability and speed that is unprecedented.”

The U.S. battery companies that can harness the “Three C's” — building capacity, developing a competent workforce, and pursuing competitive results through innovation — are those most likely to enjoy outsize success in this rapidly expanding field. The opportunities emerging via the industry in the last several years will only continue to grow—and U.S. entrepreneurs and policymakers would do well to pay close attention to their ongoing evolution.